Just looking to buy Bitcoin?

Use these links:

https://www.swanbitcoin.com/craigshipp

and https://invite.strike.me/PCLUJ3

Want to learn more about Bitcoin?

See all the content below!

NOT YOUR KEYS - NOT YOUR BITCOIN!

If You own a significant amount of Bitcoin it's best to secure it with a hardware wallet (signing device).

For example the

Cold Card or

Trezor solutions.

BE YOUR OWN BANK! - Transactions can NOT be stopped, censored or reversed.

FOR ONCE YOU CAN CONTROL YOUR OWN WEALTH!

BITCOIN is a pristine bearer asset!!

₿ITCOIN NOT CRYPTO!!!!!!!

NEVER SELL YOUR ₿ITCOIN!

HARD MONEY WILL DEFUND EVIL!

Check out the two videos below from the July 26 & 27, 2024 Bitcoin Conference:

Bitcoin is blind - It doesn't care about: Race, National Origin, Gender, Creed, Status, Political Party or Profession

BITCOIN IS BASED ON RULES NOT RULERS

Bitcoin (BTC) is the next Bitcoin - Skip the altcoins!

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” — Satoshi Nakamoto — With Bitcoin we trust math!

99% of the people don't know what they don't know about ₿itcoin. I use Swan to buy ₿itcoin. Use this link to signup: https://www.swanbitcoin.com/craigshipp

Special Note: Bitcoin is going through price discovery 24/7/365. When priced in fiat (e. g. USD) the price of Bitcoin is volatile. This is always the case with a new asset class. That said, over the last ten years Bitcoin has out performed every other major asset class. My plan is to continue to buy and hold Bitcoin for the long term. As the Bitcoin Network continues to grow, due to the fixed supply (21 million Bitcoin), the purchasing power of Bitcoin will go up over time. This is supply and demand pricing in action.

Do you do nostr? My public key = npub1xm72excjdmn9uaswp685ucszq42zw4tzqdd5pjs329zjcmuksp8s2zlvkd

The Strike app is available on iOS and android phones. It's a fast easy way to send USD or Bitcoin around the world at almost no fee. Click Here to sign up and try it out! Note: Strike will reward you with $10 for signing up! Questions? Call 240-753-0024 and leave word and I'll call you back.

Another option for buying Bitcoin is RIVER.COM

Signup with this link: https://river.com/signup?r=OYC57ZG7

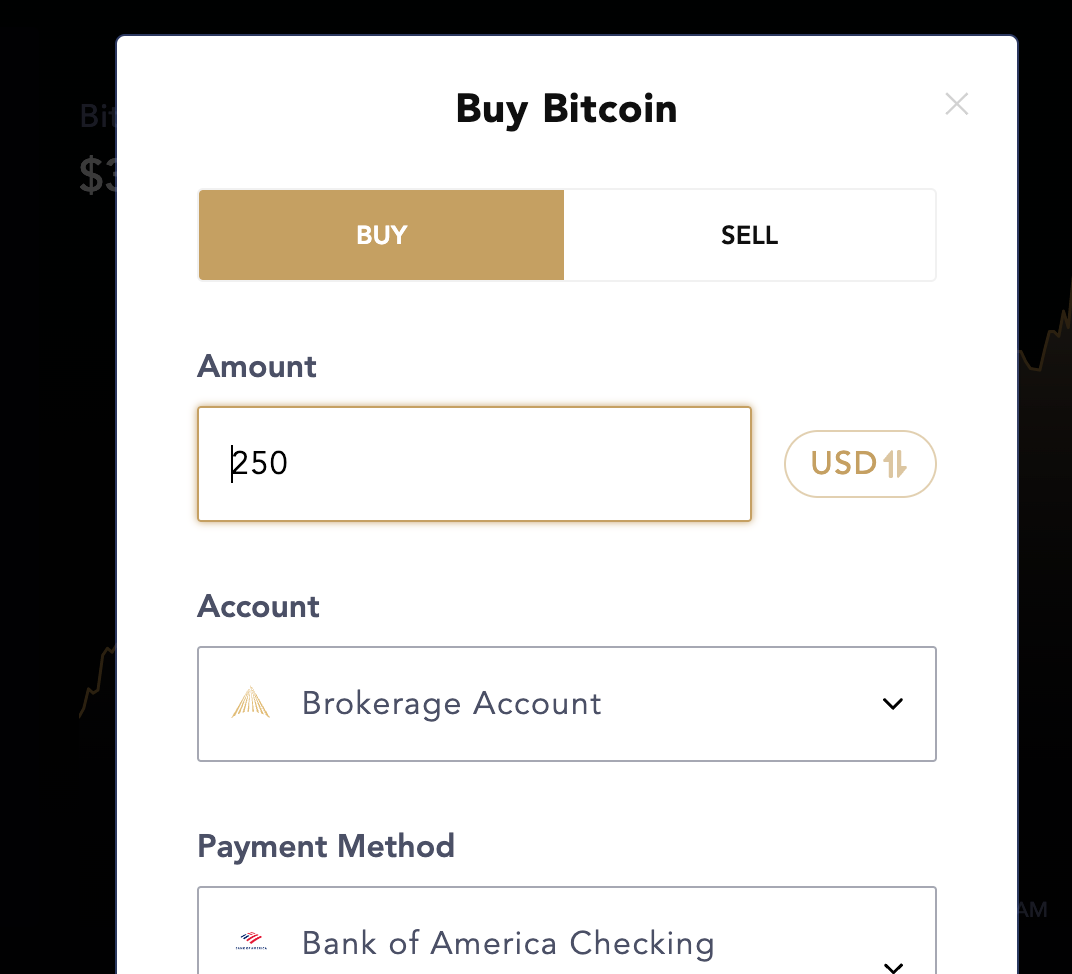

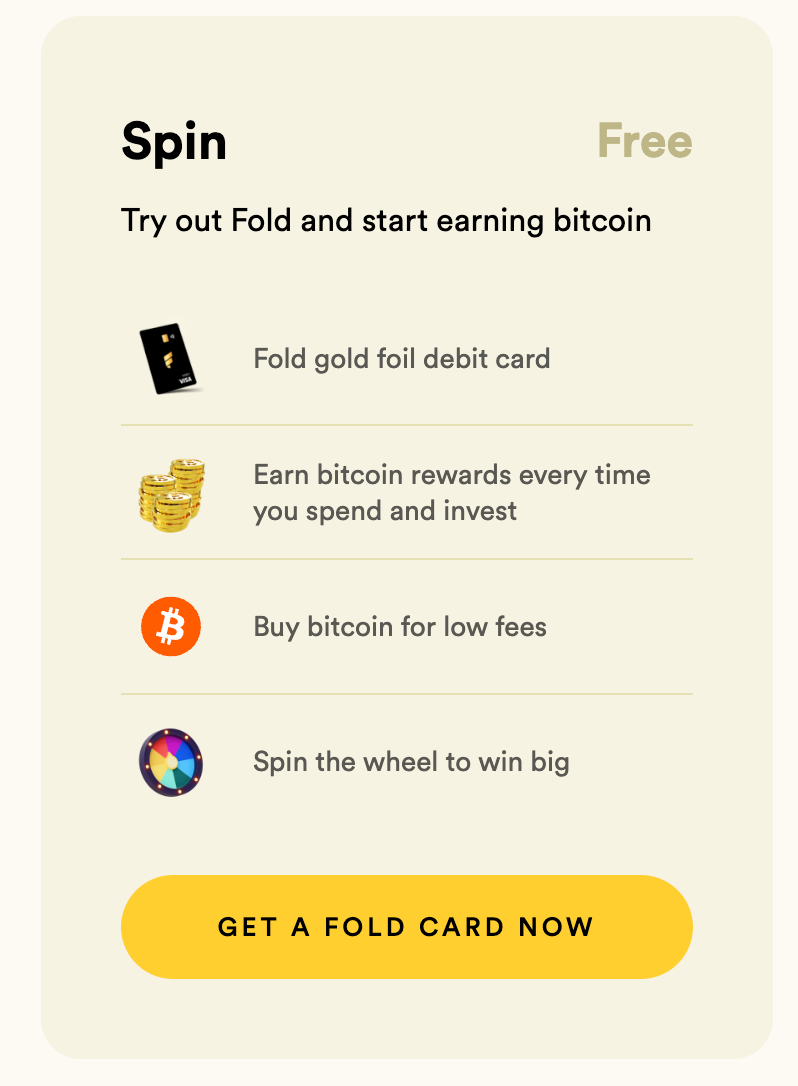

About the FOLD APP: We’re here to bring Bitcoin to everyone. While current on-ramps are complex, expensive and primarily built for speculators, we believe in ushering in the next wave of adoption via fun & engaging on-ramps built for everyone else: spenders, earners and savers.

Link to signup:

https://use.foldapp.com/r/7XAXXUHA

Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, interviews Fred Krueger about the Bitcoin ETFs (March 14, 2024 Bitcoin at $70,000 USD). See below:

Thursday, January 11, 2024 the Bitcoin ETFs [11 of them] were approved by the SEC. Even Larry Fink of Blackrock is now a Bitcoin fan! This after years of trash talking Bitcoin. In time they will all acquiesce.

See video below:

Full episode with @saylor streaming on X, YouTube & all podcast platforms covering:

— Natalie Brunell ⚡️ (@natbrunell) August 4, 2023

⬩Spot Bitcoin ETFs

⬩ #Bitcoin Halving

⬩Can #Bitcoin 'back' the dollar?

⬩ #crypto regulation, Grayscale lawsuit

⬩ Building wealth if you live paycheck to paycheck pic.twitter.com/DXfchg84Zf

YES!! If you sign up for these FREE apps (above and below) you will receive some USD money for your time. You can then use that FREE money and buy some Bitcoin HARD money! Remember your fiat currency (e. g. USD) loses purchasing power over time via inflation. Over time Bitcoin gains in purchasing power. Bitcoin is programmed to be deflationary over time. That said the Bitcoin price in USD is volatile. It's best to simply buy and hold Bitcoin for the long term.

The Cash App is another way to buy Bitcoin - Get $15 FREE for signing up! Use this link: https://cash.app/app/QNRWXDJ

Bitcoin's Key Innovation: Proof of Work + Difficulty Adjustment + 21,000,000 HARD CAP!

December 8, 2023 Bitcoin Meetup at Adventure Park USA

Craig Shipp is at the 09:00 timestamp below:

Craig Shipp interviews Jeff Booth - See below:

BritishHODL was LIVE on MidAtlanticTV.com - see below:

It's not too late to be early to Bitcoin. See video below:

Below is a great video showing Larry Fink's [Blockrock] changing views about Bitcoin.

Note: When he says "crypto" he means Bitcoin.

Full Bitcoin Audible Price Target podcast = https://pca.st/5c3se5nd

Books to read:

Gradually Then Suddenly by Parker A. Lewis at thesaifhouse.com

Here Comes Everybody: The Power of Organizing Without Organizations

21 Lessons: What I've Learned from Falling Down the Bitcoin Rabbit Hole

The Bitcoin Standard: The Decentralized Alternative to Central Banking

The Price of Tomorrow: Why Deflation Is the Key to an Abundant Future

The Sovereign Individual: Mastering the Transition to the Information Age

The Blocksize War: The Battle for Control Over Bitcoin’s Protocol Rules

Inventing Bitcoin: The Technology Behind the First Truly Scarce and Decentralized Money Explained

Bitcoin: Sovereignty Through Mathematics

Truth Decay - How Bitcoin Fixes This: Unveiling the Path to Financial Freedom

The Creature from Jekyll Island: A Second Look at the Federal Reserve

The War on Cash: How Banks and a Power-Hungry Government Want to Confiscate Your Cash

Bitcoin: Everything Divided by 21 Million

Woke, Inc.: Inside Corporate America's Social Justice Scam

Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas—Not Less

The Moral Case for Fossil Fuels

The Ethics of Money Production

The Genesis Book: The Story of the People and Projects That Inspired Bitcoin

Book list brought to you by: http://TimeChainCalendar.com

Robert Breedlove interviewed by Craig Shipp below:

Remember it's Bitcoin NOT "crypto"!

Below: A word about Central Bank Digital Currencies CBDC:

₿itcoin = FREEDOM = HOPE

It's still early. 99% of the people don't know what they don't know about ₿itcoin.

I use SwanBitcoin to buy ₿itcoin. Use this link to signup: swanbitcoin.com/craigshipp

Strike is also a great option for buying Bitcoin. Use this link to signup: https://invite.strike.me/PCLUJ3

PRO TIP: It's Bitcoin not "crypto". Most, if not all, "crypto" "projects" are scams. e. g. altcoins, ICOs, defi and NFTs are perfect examples of scams. It's best to simply buy and HOLD #Bitcoin.

"If you think the Internet has been a big deal over the last 30 years just wait until you see what impact ₿itcoin and the Lightning Network will have on our lives over the next 30 years." Craig Shipp - 2016

When Bitcoin is down don't panic. Just be like Mike and HODL! See video below:

Worried about Bitcoin price volatility? Watch the video below.

There are two things that will revolutionize our world: Bitcoin and true freedom.

Freedom is not only important to Bitcoin and financial systems, but it is also essential to human flourishing. History has shown us time and time again that societies that value freedom, individual rights and especially property rights, are the ones that prosper and thrive.

When individuals are free to pursue their own goals and ambitions, they are more likely to be creative, innovative, and productive. They are especially willing to take risks, to try new things, and to push the boundaries of what is possible if they can build wealth in the process. This is what drives progress and growth in any society.

In contrast, societies that are characterized by oppression, tyranny, and a lack of individual freedoms are often stagnant, impoverished, and lacking in innovation. When individuals are not free to express themselves, to pursue their own interests, or to challenge the status quo, they are less likely to take risks or to engage in activities that might lead to progress and growth.

Moreover, freedom is essential to human dignity and well-being. When individuals are denied their basic human rights, they suffer not only material deprivation but also psychological and emotional harm. They may feel powerless, disengaged, and disconnected from society. This can lead to feelings of resentment, despair, and even violence.

In short, freedom is essential to human flourishing. It is the foundation upon which all other human rights and liberties are built, and it is essential for the development of thriving societies. So let us continue to value and defend individual freedoms, and let us work together to build a world where freedom and prosperity go hand in hand.

Bitcoin, as you may already know, is a decentralized digital currency that has taken the financial world by storm. It is a peer-to-peer system that operates without the need for intermediaries such as banks or financial institutions. This has given people more control over their own money, allowing them to send and receive funds across borders without restrictions or high fees.

But Bitcoin is not just a currency. It is a symbol of freedom. For too long, we have been controlled by big, overreaching governments and the central banks that regulate our financial systems. These institutions have taken advantage of their power, creating policies that favor the wealthy few at the expense of the rest of us.

Bitcoin is different. It is a currency that is owned and controlled by the people. It cannot be manipulated by governments or central banks. It operates outside of the traditional financial system, giving people the freedom to transact without interference or censorship.

Bitcoin is a beacon of hope for those who value freedom and independence. It offers a way for people to protect their wealth and escape the clutches of a corrupt financial system. It is a way for people to take back control of their financial lives and achieve true financial freedom.

But let me be clear, this is not just about money. It is about the freedom to live our lives without the fear of government overreach and the power of central banks. It is about the freedom to transact with whoever we choose, without fear of censorship or surveillance. It is about the freedom to innovate and create new solutions that benefit society without the fear of being shut down by those in power.

One of the key advantages of Bitcoin over traditional fiat currencies is that it is a hard money system rather than a debt-based system. This means that Bitcoin is not subject to the same inflationary pressures as fiat currencies, which are often created through the issuance of new debt.

In a debt-based system, new money is created when banks issue loans or the government engages in deficit spending. This can lead to an inflationary spiral, as the value of the currency is eroded over time by the increased supply of money.

In contrast, Bitcoin has a fixed supply that is algorithmically capped at 21 million coins. This means that there is no mechanism for creating new Bitcoin beyond this fixed limit, and the supply of Bitcoin is not subject to manipulation by any centralized authority.

This has a number of advantages over a debt-based system. For one, it means that Bitcoin is inherently deflationary, as the fixed supply means that the currency becomes more scarce over time. This can help to incentivize saving and long-term planning, rather than the short-term consumption and debt accumulation that is encouraged by fiat currencies.

Additionally, because Bitcoin is not subject to inflation, it is a more stable store of value than fiat currencies. This is particularly important for those living in countries with high inflation rates or unstable political systems, as Bitcoin can provide a way to protect wealth and maintain purchasing power over time.

Overall, the hard money system provided by Bitcoin represents a significant improvement over the debt-based fiat system that has dominated global finance for the past century. By providing a stable and predictable monetary system that is not subject to manipulation or inflation, Bitcoin offers a more reliable store of value and a better foundation for economic growth and prosperity.

We must embrace Bitcoin and the freedom it represents. We must educate ourselves and others about the power of this revolutionary technology. We must stand up to those who seek to control us and use our own money against us.

So let us stand together and embrace the power of Bitcoin and the freedom it represents. Let us build a world where individuals are truly free to control their own financial destinies and live their lives without fear of government oppression.

I must also emphasize the fact that Bitcoin is not just a revolutionary currency or a symbol of freedom, it is a significant invention discovery that is on par with some of the greatest inventions in human history.

Throughout history, we have witnessed the emergence of groundbreaking technologies that have changed the world. From the wheel, to the printing press, to electricity and the Internet, these inventions have transformed the way we live, work and interact with one another.

Bitcoin is the next in line, a groundbreaking technology that is set to transform the way we think about money and finance. It is a discovery that has unlocked new possibilities, and is changing the world in ways we could have never imagined.

Like the printing press, which allowed for the dissemination of information to the masses, Bitcoin is opening up new avenues for economic growth and financial freedom. Like electricity, which revolutionized the way we power our homes and factories, Bitcoin is powering a new era of decentralized financial systems.

And like the Internet, which connected us all and changed the way we communicate and share information, Bitcoin is connecting people from all over the world and changing the way we transact and interact with each other.

Bitcoin is a true invention discovery that is changing the course of human history. It is a testament to our ingenuity and our ability to innovate and create new solutions to old problems. It is a source of inspiration for generations to come, and a reminder of the power of human collaboration and creativity.

For thousands of years folks have tried their best to store value. Gold because of its hard money properties became the standard against which all other methods were judged. Gold was the hardest form of money until the invention and discovery of Bitcoin.

At this time it’s useful for us to define hard money. Hard money is a monetary system characterized by several key properties that make it an attractive alternative to fiat currencies. These properties include:

- Limited supply: Hard money, like Bitcoin, has a fixed or limited supply. This means that there is a finite amount of the currency that will ever be produced, which helps to ensure its scarcity and value over time. Hard money is not easy to produce!

- Durability: Hard money is typically more durable than fiat currencies. This is because it is often made from precious metals or other valuable materials that do not degrade or deteriorate over time. Now, in the digital age Bitcoin because of its security is extremely durable. It also, unlike gold or fiat, can’t be counterfeited or faked.

- Portability: Hard money is usually more portable than other forms of wealth, such as real estate or other physical assets. This is because like gold coins it is often small and compact, and can be easily transported from place to place. Even better Bitcoin can move at the speed of light anywhere the Internet is available.

- Divisibility: Hard money is typically divisible into smaller units, which makes it more versatile and adaptable to a wider range of transactions. Each Bitcoin can be easily divided into 100 million units. Gold coins can not be divided into such a small unit.

- Recognizability: Hard money is usually easily recognizable and accepted as a medium of exchange. This is because it has a long history as a form of currency and is often associated with well-established brands or symbols. The issue with gold is it’s not easy to verify. There are fake gold bars and coins. Bitcoin, however, can be easily confirm to be actual Bitcoin.

Overall, these properties make Bitcoin, a more stable and reliable form of currency than gold or fiat currencies, which are often subject to counterfeiting, manipulation, inflation, and other forms of economic instability. By providing a stable and predictable monetary system, Bitcoin can help to promote economic growth and prosperity over the long term.

Another key feature of Bitcoin that makes it truly remarkable is that it is antifragile, meaning that it actually gets stronger in the face of adversity and attempts to suppress it.

Bitcoin is a decentralized system that operates on a peer-to-peer network, meaning that it is not controlled by any one person or entity. This makes it highly resistant to any attempts at censorship or control. It operates on a global scale and is accessible to anyone with an internet connection, making it truly borderless.

Bitcoin has faced numerous challenges and attempts at suppression since its inception, from regulatory crackdowns to hacking attempts, and yet it has only grown stronger and more resilient in the face of these challenges.

This is because of the unique features that are built into the Bitcoin protocol. For example, the network is designed to be highly secure and resistant to hacking attempts, with advanced cryptography and consensus algorithms that ensure the integrity of the system.

Additionally, the Bitcoin community is highly engaged and collaborative, with developers constantly working to improve the system and enhance its features. This means that even if one aspect of the system were to fail or come under attack, there are numerous redundancies and fail-safes built into the system to ensure that it continues to operate smoothly.

In short, Bitcoin cannot be stopped because it is designed to be resilient and to only get stronger when challenged. It is a system that is constantly evolving and adapting. This ability to adapt and thrive in the face of adversity is truly one of the most remarkable aspects of Bitcoin.

In addition to the benefits that Bitcoin can bring to individuals and society as a whole, there are also significant competitive advantages for corporations, nation states, and governments that choose to embrace this revolutionary technology.

Firstly, by adopting Bitcoin, these entities can benefit from faster and cheaper transactions, as well as improved security and transparency in financial transactions. This can help businesses to operate more efficiently and with greater trust, both within their own operations and in their relationships with customers and partners.

Secondly, by embracing Bitcoin, corporations, nation states, and governments can position themselves as leaders in innovation and technology. They can demonstrate their commitment to progress and to staying ahead of the curve, which can be a powerful signal to investors, customers, and partners.

Finally, by adopting Bitcoin, these entities can gain access to a growing community of users and developers who are passionate about the technology and who are committed to building new and innovative applications on top of the Bitcoin network. This can lead to new opportunities for collaboration and partnership, as well as increased visibility and exposure for their products and services.

In short, corporations, nation states, and governments that choose to embrace Bitcoin will have significant competitive advantages over those who do not. They will be better positioned to take advantage of the benefits that Bitcoin can bring, and to lead the way in innovation and progress. So let us continue to support the growth and adoption of Bitcoin, and to work together to build a world where freedom, innovation, and prosperity go hand in hand.

Some thoughts regarding Bitcoin and energy. It is true that some have criticized Bitcoin for its energy consumption, arguing that the energy required for mining and transaction processing is excessive and unsustainable. However, it is important to understand that the energy used by Bitcoin is not simply wasted, but is in fact a necessary component of the system's security and decentralization.

The proof of work system used by Bitcoin ensures that the network is maintained by a distributed group of miners who are incentivized to act in the best interest of the network. This is what allows Bitcoin to maintain true decentralization and prevent any single entity from controlling the network.

In contrast, other systems, such as proof of stake, rely on large holders of the currency to maintain the network. This creates a risk of centralization and can result in the network being controlled by a small group of actors with outsized influence.

Furthermore, it is important to recognize that energy use is not inherently bad. In fact, human flourishing and progress have always been accompanied by increased energy consumption. As we continue to develop new technologies and innovations, it is likely that energy consumption will continue to rise.

Additionally, the use of renewable energy sources can help to mitigate the environmental impact of energy consumption. By using excess energy from renewable sources, Bitcoin mining can actually help to incentivize the development and adoption of clean energy technologies.

In short, the energy consumption of Bitcoin is not a flaw but an essential component of the system's security and decentralization. It is important to understand the value of a truly decentralized monetary system and to recognize that increased energy consumption is not necessarily a negative development, but can instead be a sign of progress and innovation.

A word about other “crypto” projects. While Bitcoin is often referred to as a "cryptocurrency," it is important to recognize that not all projects in this space are created equal. There are many so-called "altcoins," NFTs, DEFI projects, and other scams that claim to offer similar benefits to Bitcoin but are actually quite different.

For example, many altcoins claim to offer faster transaction processing times or improved privacy features compared to Bitcoin. However, these claims are often overblown or misleading, and the vast majority of altcoins are not truly decentralized or secure in the way that Bitcoin is.

Similarly, NFTs (non-fungible tokens) have gained a lot of attention recently for their use in creating unique digital assets. Lots of folks have been scammed in this space and so far there seems to be no real use case for NFTs other than taking money from those who wish to get rich quick.

Finally, DEFI (decentralized finance) projects aim to create financial services that are not controlled by traditional banks or financial institutions. While this concept is certainly appealing in theory, the reality is that many DEFI projects are highly experimental and untested, and have suffered from a number of high-profile hacks and security issues.

In contrast, Bitcoin has been around for over a decade and has a proven track record of security and decentralization. Its design is based on sound cryptographic principles and game theory, and it has weathered numerous attempts to attack or manipulate the network.

In short, while there are certainly other projects and technologies in the "crypto" space that may have some potential in the future, it is important to be wary of scams and to recognize that of the 20,000+ crypto “projects” to date none have been successful or solved any real world problems. Bitcoin stands apart as a truly decentralized and secure monetary system that has already proven its value over the past decade.

So let us embrace the power of Bitcoin and the antifragile nature of its design. Let us work together to ensure that this revolutionary technology continues to thrive and provide a beacon of hope for those seeking financial freedom and independence.

Thank you.

Craig Shipp

Below Jeff Booth explains why Bitcoin can't be stopped or challenged by "crypto".

30 Trillion USA National Debt in 2022

In early 2022 the United States of America national debt hit 30 TRILLION dollars. Most don't realize just how much money that is. Check out the video below and then you might realize the at only 21 million units Bitcoin is a rare, limited asset.

Show that you're proud of Bitcoin - Wear the Bitcoin logo!

Need to talk to someone about Bitcoin? Call 240-753-0024 and leave a message and we'll call you back!

John at http://grimes.graphics will embroider clothing items that you send to him with this Bitcoin logo (photos above).

The COLDCARD Mk4 is a recommended for securing higher amounts of Bitcoin. See video below.

Full COLDCARD Mk4 review and setup tutorial below:

Watch out the following terms: "crypto" "project" "NFT" "DeFi" "altcoins" "coin" "token" "Web3" "meta" "yield" "staking" "proof of stake" "utility" they are likely scams! Best to simply buy and hold #Bitcoin and skip other "opportunities".

I've learned from the best @TechBalt and @michael_saylor to have a strong hand and buy and hold #Bitcoin and skip the altcoins. I'll never sell my BTC! #gonewiththewind #bullbullbull #skipthealtcoins #illneverbuyaltcoinsagain #longtermthinking pic.twitter.com/5xRBxxDg7n

— ₿riFitDance (@BriFitDance) September 17, 2021

PRO TIP: Think long term. Simply buy and hold #Bitcoin and skip the altcoins and skip the trading!

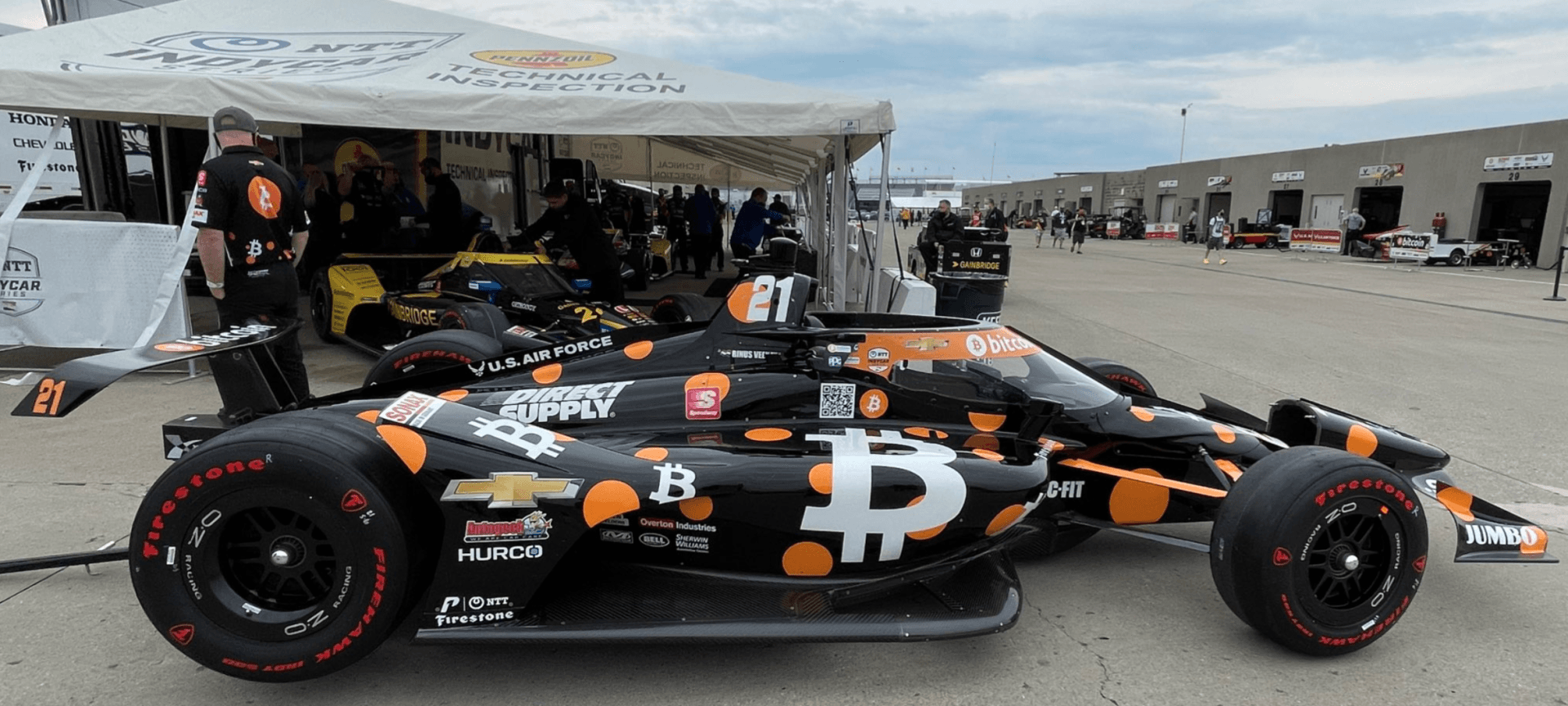

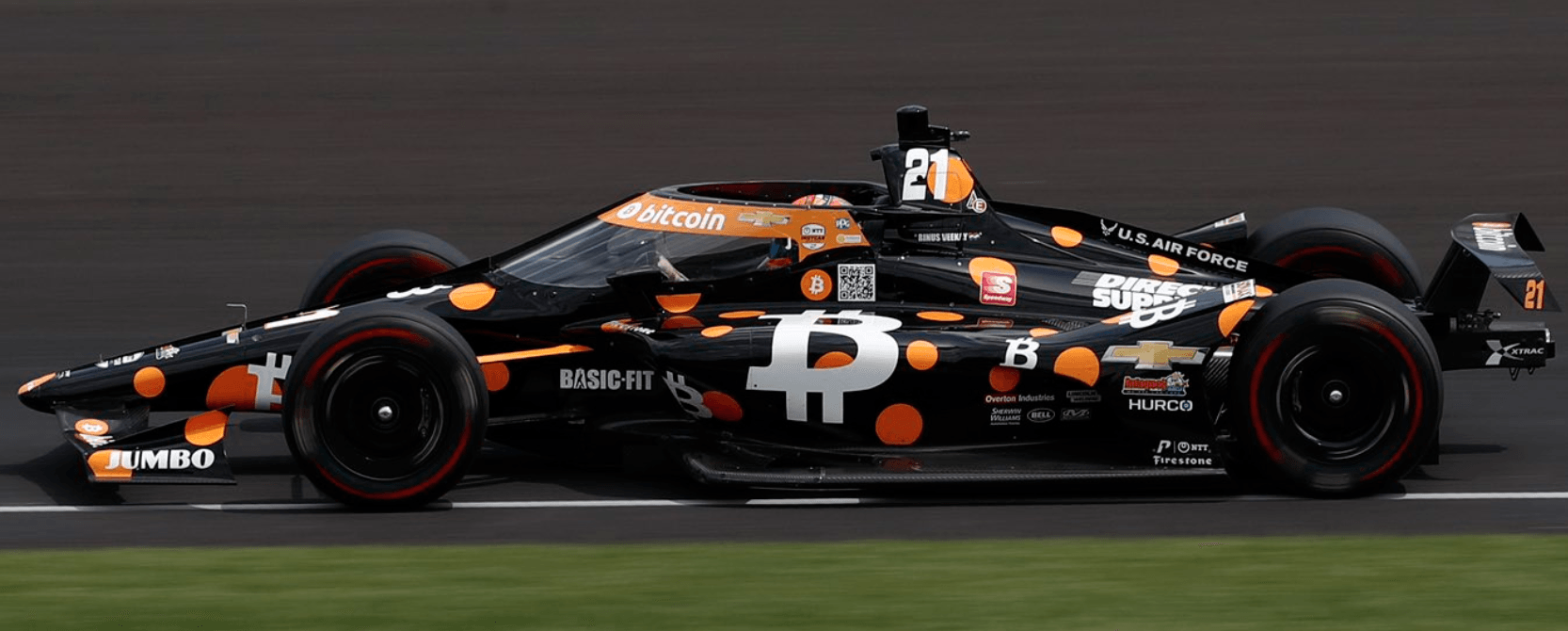

The #21 Bitcoin Ed Carpenter Racing car at the 2021 Indy 500 - Also see: https://twitter.com/ECRIndy/status/1396592644273410052 - Shoutout to Jack Mallers for making this happen! see: https://twitter.com/JackMallers - Also see: https://www.indycar.com/Series/Indy-Lights/Rinus-VeeKay

This is amazing news from Nayib Bukele the Presidente de la República de El Salvador

See the video and two tweets below:

WBD363 - Why El Salvador Made #Bitcoin Legal Tender with President @nayibbukele. We discuss:

— What Bitcoin Did (@WhatBitcoinDid) June 23, 2021

- Reality of being a dollarised nation

- #Bitcoin as legal tender

- Education and infrastructure

- Volcano mining https://t.co/F1mn84rPCX pic.twitter.com/LjeeNmdIWI

Welcome to the future 🇸🇻 #Bitcoin pic.twitter.com/j30vcZVXvJ

— Nayib Bukele 🇸🇻 (@nayibbukele) June 5, 2021

ZELLO Channel Name = Bitcoiner

Channel Description: Hanging out and talking with folks who are interested in Bitcoin, freedom, personal responsibility, and long term thinking! Open to all kind souls.

Channel URL = https://zello.com/Bitcoiner (when adding the channel in the app search: Bitcoiner)

About ZELLO - TALK LIVE and have fun. It's all FREE! (iOS and android)

ZELLO is a fun walkie talkie app for iOS and android that's a whole lot more than a walkie talkie for your phone. There are cool channels where you can talk with folks on a wide range of topics. You can also share photos, have LIVE chats and go back and listen to past conversations (as long as you were monitoring the channel the whole time). Below are some of the best channels that are open to the public. Remember to be kind!

Note: If you are monitoring channels and you don't want to be disturbed by the audio conversations, you can select the 'Busy' option at the bottom of the screen and then mute your phone with the mute button (iOS) when you're in any of your channels and that will mute all conversations for all the channels you're monitoring. Then when you're ready to listen to conversations and participate, you can switch from 'Busy' to 'Available' and unmute your phone. This allows you to not miss any previous conversations because if you shut down the app, you may miss out on conversations that take place when you're not monitoring.

Is there still time to become Bitcoin rich? See video below:

What about Bitcoin's energy use? See video below:

Interesting Bitcoin links and resources:

https://learn.saylor.org/course/PRDV151

https://twitter.com/DjSaToShi18/status/1529547335625326595

"I think there's no capacity to kill bitcoin" says @PatrickMcHenry #btc pic.twitter.com/DY70tx2TvV

— Squawk Box (@SquawkCNBC) July 17, 2019

Epic Elon Musk #Bitcoin tweet below - check out the comments!

— Elon Musk (@elonmusk) December 20, 2020

Bitcoin is unfakeable digital gold that you can instantly teleport from one impenetrable vault to another, opened only using your self-generated password, nobody able to stop your payment, with no registration or intermediary required. There will never be more than 21M bitcoins.

— Francis Pouliot 🐂₿ (@francispouliot_) December 13, 2018

Our new report “The Bitcoin Reformation“ is out. Read here: https://t.co/LA3ccXGsRL pic.twitter.com/yPIwAXydSK

— Tuur Demeester (@TuurDemeester) November 7, 2019

Rant

— Anthony 🔴 (@AnthonyDessauer) November 17, 2020

Everyone is waiting for the FOMO. It’s not going to be like 2016. The big boys have come to play. They don’t FOMO. They dominate. The positions they take will be colonial. They have long time horizons and they are not buying bitcoin with paychecks. This bull run will cause

Want to get some ₿itcoin?

Strike to Buy Bitcoin LOW FEES!

I am a long-term holder of Bitcoin. With Strike you can buy Bitcoin without paying fees!

Hey! Join Strike and earn $10 when you sign up and verify your account using my referral code PCLUJ3:

https://invite.strike.me/PCLUJ3

What is Bitcoin: https://pca.st/v4fnuoab

Also see the Understanding Bitcoin Starter Links google doc by Lawrence @AxeCapYa on twitter:

https://docs.google.com/document/d/1ciqe6-1T6fbgPCRGBoXTrYe5AKk0RlT9s30OC0IHDHc

Learn about Bitcoin and FREEDOM at: www.areaguides.com/freedom